Santacruz Silver – NASDAQ Stock Uplisting Process Underway, and A Comprehensive Q3 Operations Review In Bolivia and Mexico

Arturo Préstamo Elizondo, Executive Chairman and CEO of Santacruz Silver Mining Ltd. (TSXV: SCZ) (OTCQX: SCZMF) (FSE: 1SZ), joins me unpack the decision to uplist onto the Nasdaq exchange in the US, and to delve into the details of Q3 2025 operational results across their portfolio of producing mines in Bolivia and Mexico.

On October 28th, the Company announced that it has applied to list its common shares on the Nasdaq Capital Market (NASDAQ); as a significant milestone in Santacruz’s growth strategy. We discussed how a big board US listing will increase transparency and liquidity to an expanded American shareholder base, and he explains the rationale for going with the NASDAQ over the NYSE. In connection with the proposed listing, the Company will seek shareholder approval at the upcoming AGSM for, among other things, a consolidation of its common shares to meet Nasdaq’s initial listing requirements, which include a minimum bid price of US$4 per share.

We discussed that the share consolidation is for a positive reason and for listing requirements, which is much different than when cash-starved juniors typically roll back their shares to initiate further series of dilutive financings. Santacruz Silver paid off their loan to Glencore in September, and is generating record revenues at current metals prices; so they are in a totally different financial position than a pre-revenue junior resource stock. Their motivation for the share consolidation is merely to meet the NASDAQ listing requirements.

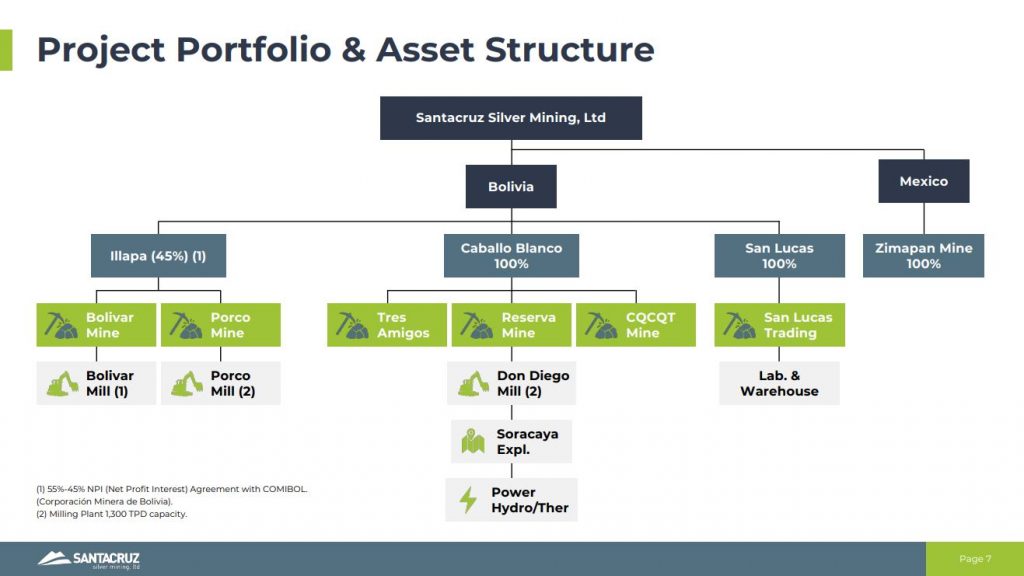

Next we had a comprehensive review of all producing operations, as well as discussing future growth through exploration around current mines, development of Soracaya, and the potential for accretive acquisitions. Santacruz Silver operates 1 mine in Mexico, and 5 mines, 3 mills, and an ore feed-sourcing and metals trading business in Bolivia, as an emerging mid-tier silver and base metals producer.

On November 3rd, Santacruz Silver reported its Q3 2025 production results from its Bolívar mine, Porco mine, Caballo Blanco Group of mines and the San Lucas Group (which includes the Reserva Mina) and the San Lucas feed sourcing business, all located in Bolivia, and the Zimapan mine located in Mexico.

Q3 2025 Production Highlights:

- Silver Equivalent Production: 3,424,817 silver equivalent ounces

- Silver Production: 1,241,929 ounces

- Zinc Production: 21,581 tonnes

- Lead Production: 2,603 tonnes

- Copper Production: 331 tonnes

During Q3 2025, Santacruz maintained steady consolidated production, supported by strong operational performance from Caballo Blanco and San Lucas, which helped offset the lower silver production at the Bolívar mine. This third quarter captured the largest impacts of the water inflow event that first occurred at the Bolívar Mine in May 2025. Since then, their operations team has been actively working on strengthening the pumping system at Bolívar, with the fourth line commissioned in September and the installation of a fifth submersible line underway, which together will increase total pumping capacity to 340 liters per second (l/s). These improvements are facilitating the gradual dewatering and recovery of the affected zones in the Bolívar mine. The Company expects production from the high-grade Pomabamba and Nané areas at Bolívar to resume in February 2026 and ramp up steadily through the remainder of the year.

In Mexico, Zimapán continued to deliver stable production, reflecting consistent plant throughput and recoveries. we discussed the higher-grade 960 Level at the Zimapan Mine starting to contribute, and how this will continue growing in the Q3 and Q4 production profile from Zimapan for the balance of this year and for many years into the future.

If you have any follow up questions for Arturo regarding Santacruz Silver, then please email those to me Shad@kereport.com.

- In full disclosure, Shad is a shareholder of Santacruz Silver at the time of this recording, and may choose to buy or sell shares at any time.

For more market commentary & interview summaries, subscribe to our Substacks:

The KE Report: https://kereport.substack.com/

Shad’s resource market commentary: https://excelsiorprosperity.substack.com/

Investment disclaimer: This content is for informational and educational purposes only and does not constitute investment advice, an offer, or a solicitation to buy or sell any security. Investing in equities and commodities involves risk, including the possible loss of principal. Do your own research and consult a licensed financial advisor before making any investment decisions. Guests and hosts may own shares in companies mentioned.

Click here to follow the latest news from Santacruz Silver

.

.

Interesting 195 minute chart, the 200 MA looks like important support…

https://schrts.co/KSpZYiCy

Looks like SCZ filled the $1.82 gap from late August, haha…

I noticed that. All the (“risk-on”) silver stocks need now is for the gov shutdown charade to end. CDE has already fallen 29% twice in an ABC decline and has found support at the 195 min 250 MA (250 being roughly equal to 6 months).

https://schrts.co/cGmSKfJV

My CDE buy well below 14 the other day looks pretty good so far but it looks like it might underperform IPT for awhile.

https://schrts.co/rRBzmXIZ

IPT is at a very different place cyclically than most other silver plays which has allowed it to hold up better than most over the last few weeks.

https://schrts.co/NJaRfjxA

The recent bottom hardly affected the MACD.

Silver 4 hour… I have been watching the price movements on silver, I have put my money on a surprise move, IMO only.

Silver 15m…

There we go!

PGE, anyone else watching?

We are now trading in… the dead zone… 9:45-11;15 MST… or, Toronto lunch time.

They are like producing 14m oz, yet has a market cap of $650M. Shouldn’t they be worth Billions? They must make a bunch of money right now? What am I missing with SCZ?

Thanks

… time…

Agreed Ulf-the-Wolf. Santacruz Silver should be well over a $Billion based on their production profile, and what other peer producers have (and have had) for market caps.

Santacruz Silver produced over 16 million silver equivalent ounces last year and is on track to do close to that this year, which is far more than what Silvercrest or Gatos were doing (both taken out near $2Billion market caps). It is far more production profile than Endeavour Silver and Aya Gold and Silver by a landslide, and they both attained valuations well over a $Billion last year and this year. Santacruz needs to triple just to get up to a fair peer comparable valuation.

I’ve written about this valuation arbitrage in SCZ in my Substack articles frequently over the last year, and it is why I bumped it up to my largest weighted position earlier this year. I did trim back some profits in Sept/Oct though, and have now moved Americas Gold and Silver (USAS) to my largest weighted position for their turnaround & growth strategy + 2026 they’ll start getting paid (instead of penalized) on their antimony, gold, and copper production.

FREAKY FRIDAY AGAIN…………

Endeavor is on the hook for 68,000 of gold at $2200, which will take them potentially 2 years to produce from their new mine.

This could generate huge mark to market losses for them if gold continues to rise from here over the next 2 years, which I expect it will in a big way.

Can anyone tell me why I shouldn’t sell EXK and buy an unhedged miner like HL or AG today (with the assumption that they are all going to perform equally from an operational perspective and rising silver and gold prices over the next 2 years)?

Endeavour Silver has plenty of gold exposure (about 40%) from all their mines (most of which isn’t hedged that will participate in the full upside in any gold price appreciation).

As for assuming all silver/gold stocks are on par operationally… that’s not true. No, they won’t all perform the same operationally and First Majestic has been an underperformer compared to their peer group for many years now, despite the huge following Keith has in the silver space. Hecla hasn’t been knocking it out of the park either, but they are getting things more optimized finally.

Endeavour Silver has had MUCH more torque historically and they will continue to have it based on their production growth from both Kolpa and Teronerra moving forward the next 2 years, compared to Hecla or First Majestic or Hoschild or Fresnillo or SSR or most of the big boys (excluding Coeur that also does have great torque and growth on tap via their last 2 acquisitions).

Also, Pitarilla is one of the largest undeveloped silver projects on the planet waiting in the wings as the next development project for Endeavour Silver, once they get Teronerra up to nameplate capacity and off the launch pad. That project is a monster and on par with Cordero that Discovery Silver holds. The optionality just on that project blows away anything else on tap that First Majestic or Hecla has in their development pipelines.

In 2011, silver topped at 175% above its 50 month MA. Today, that level is above $75.

https://schrts.co/AwrmHbfs

Huge weekly bull hammer for GDX:GLD…

https://schrts.co/RRMjNBJF

Big backtests coming for CDE:SLV that should be bought (if they happen)…

https://schrts.co/BfmpJgCs

I’ve loaded back up on SCZ…

https://schrts.co/JSzBBcwi